ENDOWMENTS & FOUNDATIONS

Endowments and Foundations are always working to make tomorrow better with the added responsibility to manage your organization today. Choosing Bryn Mawr Trust as an Outsourced Chief Investment Officer (OCIO) or to steward your endowment or foundation can provide you with the financial expertise and value-added service to better allow you to focus on your mission.

Institutional Advisory Services

You’re strongest when you have great networks and access to best practices. Bryn Mawr Trust helps make a strong organization accessible by offering networking and educational events for Board and staff, tailored trainings just for your organization, and a library of resources on timely issues. Our team is experienced in advising Endowments & Foundations with:

- Investment Expertise

- Resources for Board and Staff

- Learning Opportunities for Donors

- A Networked Community

- Leadership

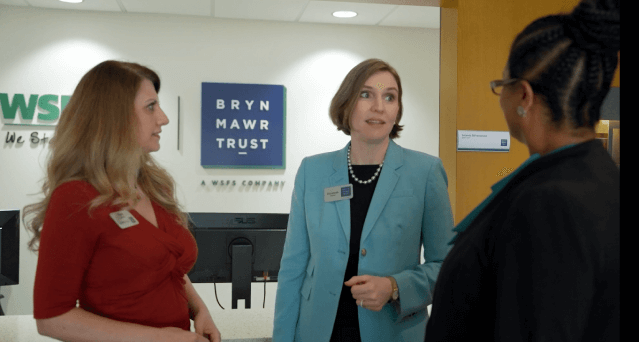

LET’S START A CONVERSATION TODAY

BUILDING SUSTAINABLE NONPROFITS

As an endowment, foundation or nonprofit leader, you know the strength and creativity of the charitable sector. Strength comes from great networks and best practices and Bryn Mawr Trust can help you achieve your goals by connecting you to:

- A robust library, regular educational and networking events for board and staff on institutional topics and connections within the field.

- Advice on building revenue with diversified revenue streams.

- Support in running a foundation, allocating grants, or help with getting the most impact of your giving.

INVEST IN YOUR GOALS

Your organization wants a partner who understands your mission with staying power and good judgment. This work requires working with a dedicated team of advisors who understand your goals and how to help your organization achieve them. When it comes to your organization’s investments and goals, we are here to listen and offer planning advice from a team dedicated to your needs.

Manage day-to-day banking

As your organization grows and becomes more complex, so do your banking needs. This is when it helps to have dedicated banking and lending experts who understand the complexities of your situation and can help with the day-to-day needs.

Put together the right plan for tomorrow, today.

As a dedicated fiduciary, your Bryn Mawr Trust team supports you, helping you manage the foundation to define and achieve your giving priorities.