WEALTH MANAGEMENT SERVICES

With our extensive suite of wealth planning solutions, investment management services, and private banking offerings, your Bryn Mawr Trust team can help you manage every aspect of your financial world, creating a cohesive strategy that aligns with your personal and professional goals and aspirations.

Bryn Mawr Trust takes a holistic approach to wealth planning, helping you secure your financial future through our unique wealth planning solutions, personalized service, and customized advice, delivered locally by professionals you can trust.

Our Wealth Management Services

As a Client of Bryn Mawr Trust, you gain access to an array of financial services that help you create a well-defined purpose for your wealth.

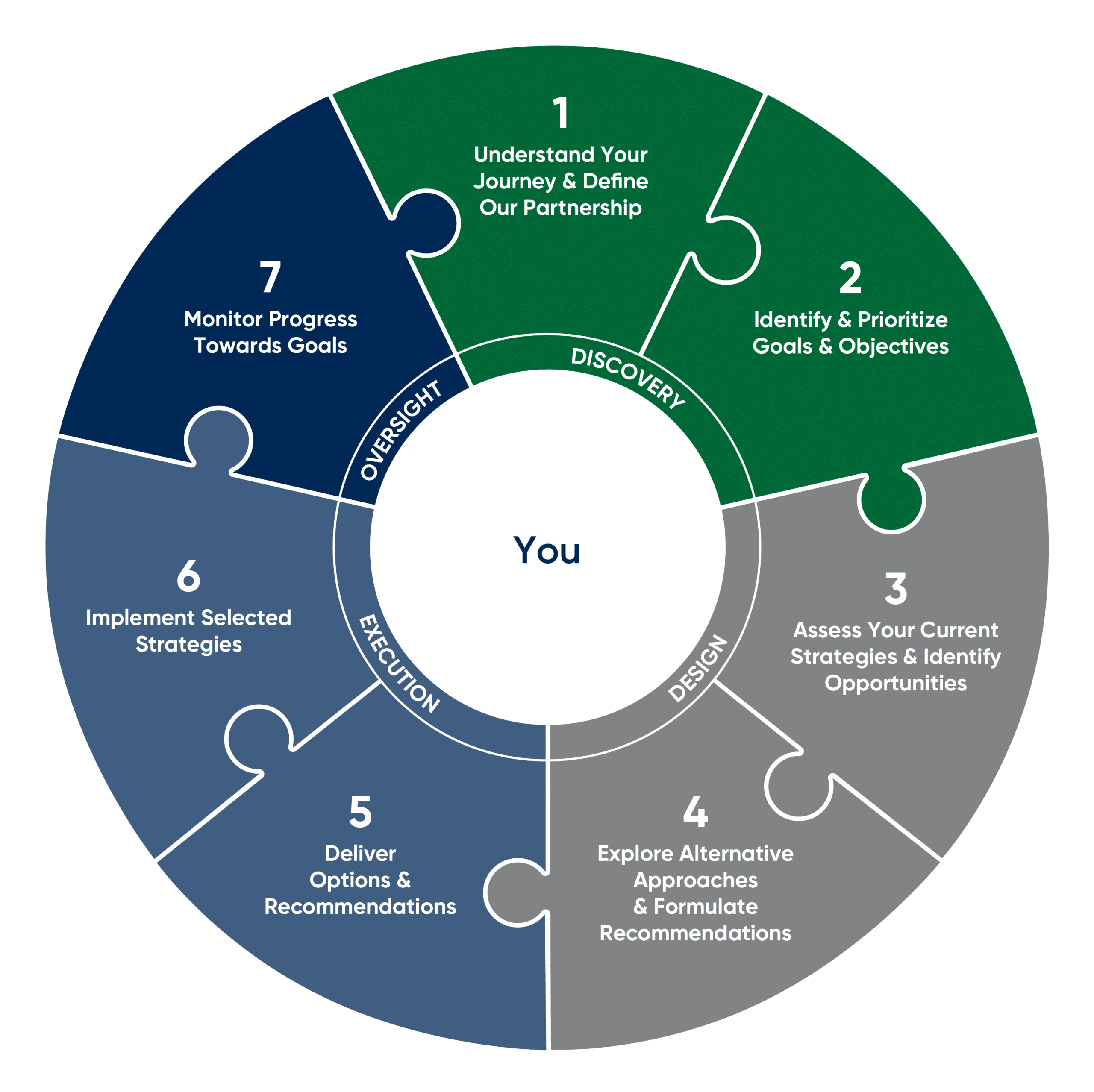

Our 7-Step planning process